SAFE Robot PRO EA MT5 unlimited

$2,800.00 Original price was: $2,800.00.$49.99Current price is: $49.99.

The package includes:

+ Expert : SAFE Robot PRO (.ex4)(version 1.3)

+ Guide

More info/Result:

+ https://www.mql5.com/en/market/product/97763

Note (Important):

This product using custom DLL “msimg32.dll”

Some antivirus may block it and flag it as a virus.

You need to make your antivirus “allow it”

Its a false alarm and its SAFE ,this false alarm is triggered because this is a custom DLL and not verified to any publisher but need to make this product unlocked

Out of stock

SAFE Robot Pro is a fully automatic robot that has the level of a professional trader.

The robot uses a completely new and unknown strategy. During real trading, he does not look towards history and acts according to circumstances.

SAFE Robot PRO went through detailed optimization in the cloud, using a special utility based on neural networks. As a result of the work, universal base points were formed for working on different brokerage companies and accounts.

The robot was trained for a long time on these basic points, as a result of which an empirical formula was found for opening / closing orders, as well as for increasing the lot.

The formula significantly improves performance and allows you not to analyze historical data during real trading and act according to the situation.

For this reason, the main control parameters for optimization are hidden, since their values change all the time during real trading.

Based on the current price and spread, current lows/highs are formed, as well as current support/resistance levels. They are reset when all positions of the given symbol are closed.

During operation, at the right time, the direction of trading is automatically changed either in the direction of the trend, or against it. That is, reverse trade is being implemented.

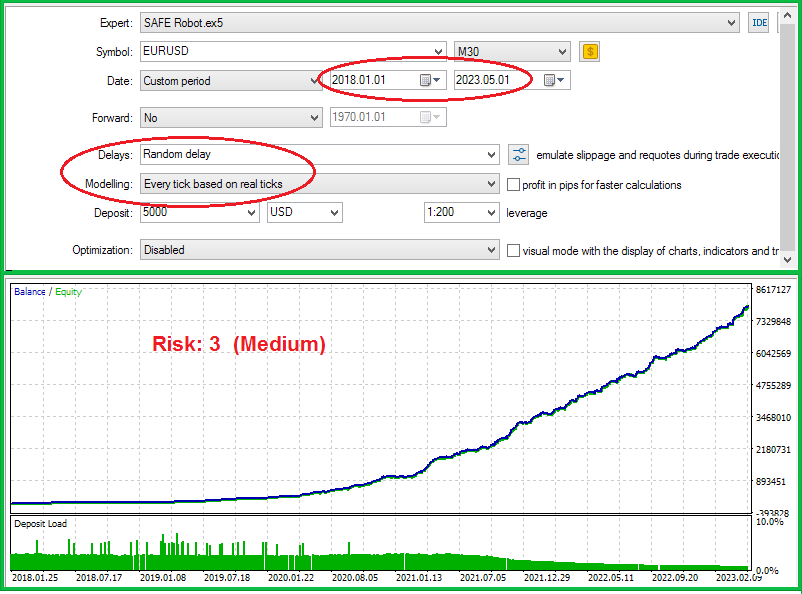

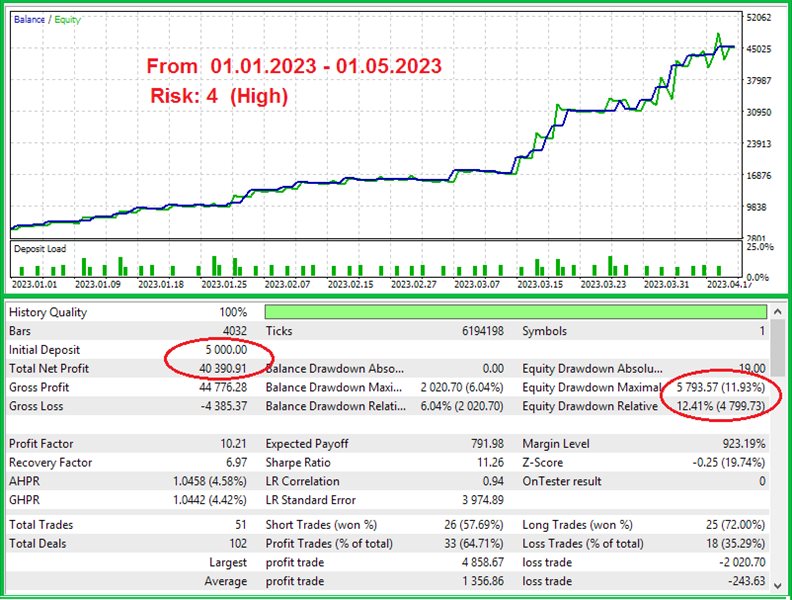

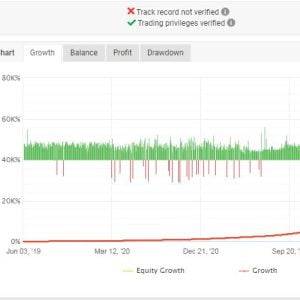

The robot has been tested for 5 years on real ticks in more than 20 brokerage companies.

It implements several trading strategies, including trend following strategies, range trading strategies, support/resistance breakout strategies.

There are 2 trading modes:

- Trading without lot increase.

- Trading with lot increase (not Martingale).

In all cases, the increase in the lot is limited by the “Margin Level”, which, if necessary, suspends the increase.

The robot also takes into account the news calendar. It does not open an order before and after the release of medium and important news, and in some cases already open orders are forcibly closed.

Processing the news calendar data prevents opening an order in the opposite direction.

You can choose different trading risk modes. Right on the chart with one click you can change their values during trading.

The robot has no external settings. All these parameters are located in the control unit. They are interconnected and dynamically change their values during trading all the time.

For example, such parameters as support / resistance levels, virtual pending orders, virtual Take Profit (TP), Stop Loss (SL), as well as Trailing Stop, which is used to transfer positions to breakeven.

All this can be visually seen in the video.

On the chart shows the parameters for selecting the operating mode:

- Working hours: 0 – do not open new orders, 1 – work only on weekends (for BTCUSD/BITCOIN ), 2 – work on all days

- Lot increase: OFF/ON

- Risk level: 1-Very Low, 2-Low, 3-Medium, 4-High, 5-Extremal

- Drawdown – Additional Stop Loss, % of the balance (drawdown) at which the position is closed.

- “Close/Reset” button – for manual closing of all positions of the given symbol (for Hedging and Netting accounts)

The minimum lot for opening an order is set automatically, depending on the size of the balance and the selected risk.

Requirements for the robot:

- Main symbols: EURUSD, GBPUSD and other pairs (on EURUSD shows the best result)

- Account currency: USD/EUR/BTC/RUB/JPY

- Timeframe: any Account Type: Standard/Pro recommended, no commission.

- Minimum deposit: $300 or more. Recommended $1000 or more Leverage – Starting at 1:30 or more. Recommended 1:100 – 1:500 or

In addition to EURUSD, the robot can trade on any instrument:

Before installing the robot on the chart, you need to test it on the tester for the last month, in the mode of real ticks (Every tick based on real ticks), in order to determine the best instrument.

To do this, select the mode on the tester in the Optimization section: “All symbols selected in MarketWatch”.

From the resulting list, you need to choose the symbol that has a high profit, but with a low maximum drawdown.

Attention!

- If there is no trend (flat situation), the order is not opened.

- During the day, from 0 to 5-6 orders can be opened.

- On Fridays, a few hours before the market closes, all open positions are closed.

- Losses are recovered within 1-2 days, in some cases up to a week.

Author

Petros Shatakhtsyan is an expert in the development of automated trading systems with over a decade of experience in the Forex market.

Be the first to review “SAFE Robot PRO EA MT5 unlimited” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

Reviews

There are no reviews yet.