Forex Reviews

Market Cycles Order Flow EA Review 2024

Market Cycles Order Flow EA Introduction

Market Cycles Order Flow EA is a sophisticated Expert Advisor (EA) designed by Thang Chu, a developer with over 7 years of experience in the forex trading industry. This EA is a part of the Nexus Portfolio, renowned for its stability and long-term performance. Priced at $2,400 for purchase, with rental options available at $120 per month, $360 for three months, $720 for six months, and $1,440 for a year, this EA stands out as a premium tool for serious traders.

Market Cycles Order Flow EA Features

- Non-Martingale Strategy: Avoids risky strategies like martingale, grid, or averaging.

- Proprietary AI Model: Utilizes retail trader sentiment and nine different indicators, including MACD, Smoothed Moving Average, RSI, TDI, and ADX, to identify market cycles.

- Live Trading Consistency: Matches backtest results closely, with over 26,000 pips gained in live trading since 2020.

- Multi-Asset and Multi-Timeframe: Supports XAUUSD, USDJPY, GBPJPY, EURJPY, and XAUJPY across multiple timeframes and strategies.

- Diversification: Includes 20+ trading strategies for five assets, enhancing risk management.

- Proven Edge: Demonstrates stability and profitability in both backtest and live trading environments.

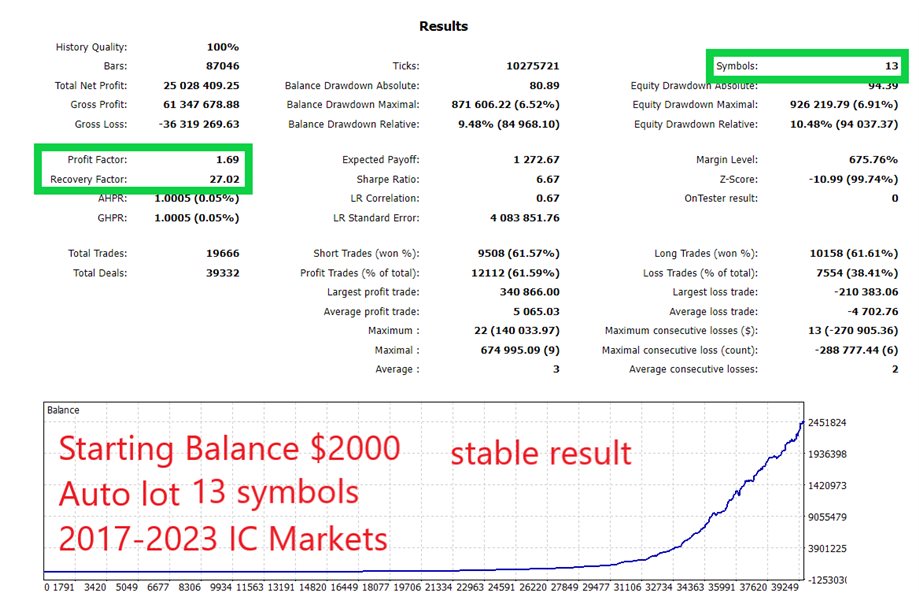

Market Cycles Order Flow EA Backtest & Trading Results

Backtest Results:

- Total Net Profit: $4,084,280.36

- Profit Factor: 1.95

- Maximum Drawdown: $232,481.37 (96.50%)

- Starting Deposit: $1,000 with 0.75% risk per trade

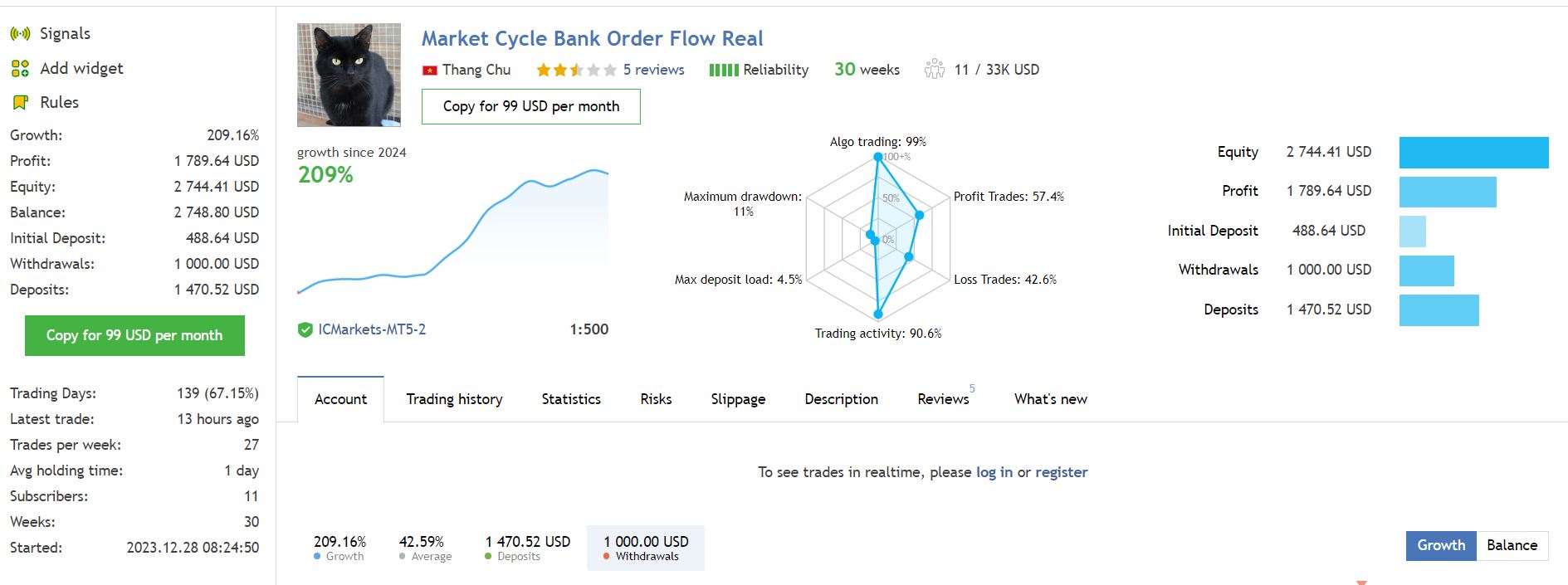

Live Trading Results:

- Growth: 209.16%

- Profit: $1,789.64

- Equity: $2,744.41

- Balance: $2,748.80

- Initial Deposit: $488.64

- Withdrawals: $1,000.00

- Deposits: $1,470.52

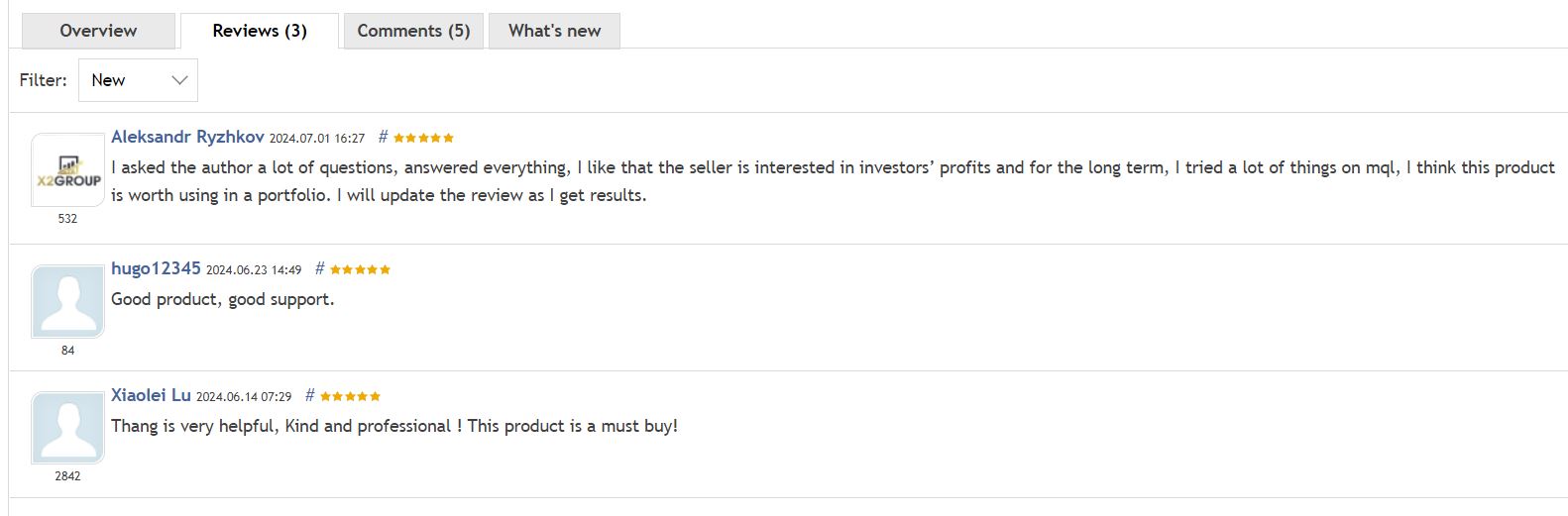

Market Cycles Order Flow EA User Reviews

- Aleksandr Ryzhkov: “I asked the author a lot of questions, answered everything, I like that the seller is interested in investors’ profits and for the long term, I tried a lot of things on mql, I think this product is worth using in a portfolio. I will update the review as I get results.”

- hugo12345: “Good product, good support.”

- Xiaolei Lu: “Thang is very helpful, kind, and professional! This product is a must-buy!”

Market Cycles Order Flow EA Pros and Cons

Advantages of the EA

- Stable Performance: Long-term stable backtest results.

- No Risky Strategies: Avoids martingale, grid, or averaging.

- Consistency: Real trades match backtest results.

- Diversified Strategy: Incorporates multiple strategies across various assets.

- High Returns: Proven high return with lower risk compared to other EAs.

Disadvantages or Limitations of the EA

- High Price: The cost might be prohibitive for some traders.

- Complex Setup: Requires specific indicators and broker settings.

- High Drawdown: Backtest shows a significant drawdown, which might be concerning for risk-averse traders.

- Hedging Account Required: Needs a specific type of account and broker time zone for optimal performance.

Conclusion

Market Cycles Order Flow EA, developed by Thang Chu, offers a robust and sophisticated trading solution for experienced traders. With its non-martingale strategy and proprietary AI model, it provides a reliable and stable trading experience. Despite its high cost and complex setup, the EA’s proven performance in both backtest and live trading environments makes it a valuable addition to any serious trader’s portfolio. Its ability to closely match backtest results in live trading is a testament to its quality and reliability, setting it apart from many other EAs in the market.

For more EAs, check out our best expert advisors for MT5 on mqlshop.com.