Forex EAs (Robots)

HFT Prop Firm EAs: Your Path to Automated Trading Success

HFT Prop Firm EAs: Your Path to Automated Trading Success

High-Frequency Trading (HFT) Prop Firm EAs (Expert Advisors) represent the cutting edge of automated trading, marrying technological prowess with financial opportunity. Designed to execute trades at lightning speed, these systems harness sophisticated algorithms to exploit tiny price differences that occur in financial markets, often within microsecond timeframes. Armed with the capital of proprietary trading firms, traders employing HFT EAs can make the most of fleeting market opportunities that might otherwise go unnoticed by the human eye. The allure of these EAs lies in their unflagging precision and relentless efficiency, working tirelessly 24/5 to maximize potential profits while enforcing strict risk management protocols that safeguard investments. For traders ready to embark on this automated journey, the key lies in understanding the nuances that influence the deployment of these powerful EAs within prop firm frameworks.

Understanding HFT Prop Firm EAs

At the heart of a successful trading strategy with HFT EAs is mastering the foundational elements that these tools are built upon. Each EA is crafted meticulously to thrive within the unique conditions of proprietary firms, necessitating a grasp of the essential attributes that define their operation. This understanding serves as a springboard into the nuanced world of HFT trading, equipping traders with the insights needed to optimize their setups and seize their trading goals.

What Is an HFT Prop Firm EA?

High-frequency trading (HFT) Prop Firm EAs are specialized algorithmic trading systems that execute a large volume of trades at exceptionally high speeds. These systems are built to thrive in the proprietary trading firm environment, where they utilize the firm’s capital to undertake advanced trading strategies. Unlike traditional trading, which might be akin to a sailing cruise elegant, measured, and reliant on human intervention HFT trading is more like a jet-fueled race, where speed and precision are the make-or-break factors. What makes HFT EAs particularly fascinating is their ability to navigate the financial markets with minimal latency, acting upon price discrepancies before they become apparent to the competition.

Explore our Prop Firm EA products to find the best solutions for your trading needs.

The core essence of HFT Prop Firm EAs is their reliance on complex algorithms capable of rapid data analysis and trade execution. These algorithms are the gears turning the trading machine, designed to identify profitable market opportunities by computing vast volumes of data in milliseconds. Imagine a chess player who contemplates ten moves ahead in a matter of seconds; similarly, a well-tuned EA can determine a profitable trade setup while others are still contemplating their first move.

- Speed: Capability to execute transactions in microseconds.

- Volume: Executes thousands of trades in a short period.

- Efficiency: Operates continuously, optimizing gains.

Another hallmark of these EAs is their inherent objectivity; they are devoid of the emotional biases that can plague human traders. These robots remain unmoved by fear or greed, responding solely to the underpinning rules and parameters set by their algorithms. Such dispassionate trading ensures consistent performance aligned with strategy design, adhering to predetermined risk management contingencies. However, it is crucial for traders to recognize that the success of an EA hinges on the robustness of its algorithm and its ability to adapt to the ever-changing market conditions.

Key Features of a Powerful HFT Prop Firm EA

A powerful HFT Prop Firm EA boasts an array of features that ensure it can meet the demands of high-speed trading environments. These features are the elements that enable EAs to stay ahead of their peers and deliver consistent performance in the fast-paced world of trading.

High-Speed Execution is the backbone of HFT trading, akin to the engine of a high-performance race car. The ability to execute trades at breakneck speeds enables traders to capitalize on transient market inefficiencies with a precision that is beyond human capability. By reducing latency, these EAs can process and respond to market data rapidly, ensuring trades are entered and exited swiftly.

Advanced Algorithms serve as the brains behind these operations. They are crafted to analyze market conditions and execute trades based on complex calculations and historical performance data. This ensures decisions are driven by data rather than emotion, maintaining consistent adherence to trading strategies.

- Backtesting and Optimization: Fine-tune based on historical data.

- User-Friendly Interface: Ease of navigation and customization for traders.

Robust Risk Management is integral to protecting capital in volatile markets. This involves setting specific parameters for stop-losses and take-profits to cap potential losses. Additionally, the ability to backtest trading strategies is crucial, as it allows traders to refine their approach by examining how an EA would have performed in historical scenarios.

Lastly, a user-friendly interface is imperative as it allows traders to easily customize and manage their EAs. This feature ensures that even those less technically inclined can navigate and adjust their trading strategies with ease. A combination of these features forms the bedrock of a successful and enduring HFT trading journey.

Choosing the Right HFT Prop Firm EA

In the quest for trading success, choosing the right HFT Prop Firm EA is a pivotal step. The beauty of HFT trading lies in its potential to deliver substantial returns, but this journey begins with selecting an EA that aligns with your trading objectives and philosophical approach.

Factors to Consider When Selecting an HFT Prop Firm EA

When selecting an HFT Prop Firm EA, compatibility with popular trading platforms such as MT4, MQL5, or cTrader is a fundamental consideration. These platforms are renowned for their support of third-party solutions and robust technical infrastructure that can handle the demands of high-frequency trading effectively. Be sure the EA is constructed to integrate smoothly with your platform of choice, facilitating seamless operation and optimal performance.

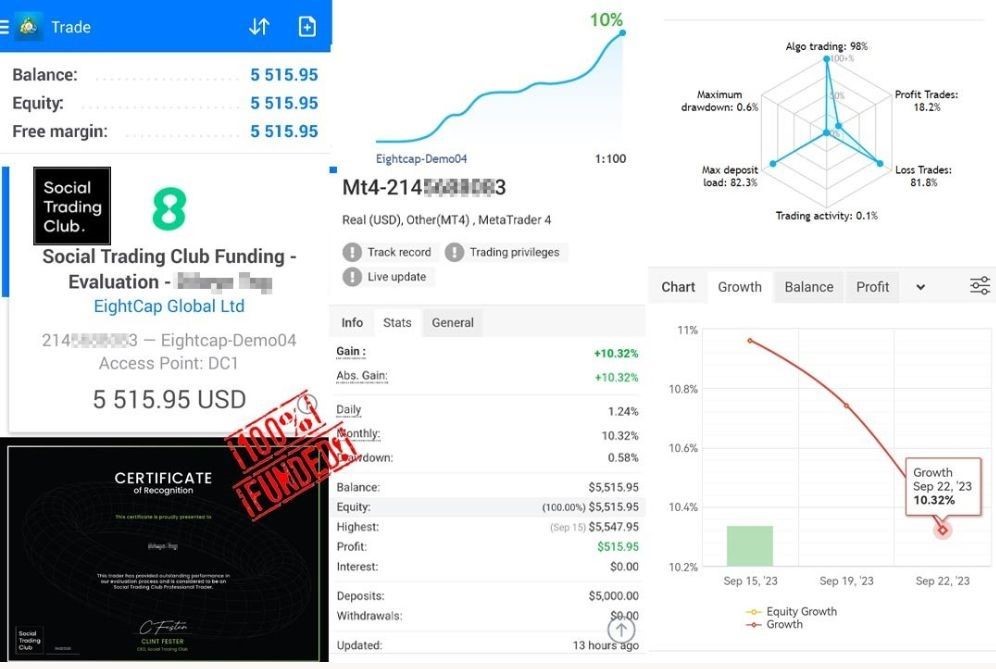

A Proven Track Record is perhaps the most telling sign of an EA’s potential. Analyzing backtesting results and live performance data provides crucial insights into how effectively an EA can perform under various market conditions. It’s akin to checking a car’s mileage before purchase; history matters, and any reputable EA will offer transparent, quantifiable evidence of past performance.

- Strong Developer Support: Assistance and regular updates.

- Cost-Effectiveness: Balancing the script’s price against expected returns.

Strong Developer Support is a must-have, ensuring traders receive timely troubleshooting assistance and updates to keep their systems in tune with evolving market conditions. Much like ensuring access to reliable customer service when buying a high-tech gadget, the availability of expert guidance can be pivotal.

Lastly, consider the cost-effectiveness of the EA. It’s crucial to strike a balance between the quality of features offered and the monetary expense involved. With some EAs demanding significant upfront costs or monthly fees, weighing these costs against potential returns determines overall feasibility and alignment with your trading strategy.

Top HFT Prop Firm EAs on the Market

Exploring the top HFT Prop Firm EAs available can unlock tremendous potential for a trader’s portfolio. Reviewing top-rated EAs allows traders to gauge which systems provide the best mix of features, reliability, and value.

The HFT Secret EA stands out for its impressive track record and performance metrics, offering traders robust tools for data analysis and trade execution. Nova Funding HFT EA is particularly well-regarded for its tailored support and trader-focused enhancements, designed to cater to diverse trading styles.

- HFT Prop Firm EA: Streamlined and efficient, with high adaptability.

- HFT Pro Evolution EA: Notable for its adaptive algorithms and risk management protocols.

Each of these options offers unique advantages, from superior execution speed to exemplary risk management features, ensuring that traders have a plethora of choices that cater to varying preferences and trading needs.

Comparing Features, Performance, and Pricing

By comparing features, performance, and pricing, traders can identify the EA that best fits their individual requirements. Factors including speed of execution, adaptability through customizable algorithms, and robust risk management capabilities must be weighed against the associated costs.

Check out detailed reviews of the 5 Top-rated HFT Prop Firm EAs.

Mastering HFT Prop Firm EAs: Tips and Strategies

Once you’ve chosen the right HFT Prop Firm EA, the next step is mastering its use to optimize your trading environment. Mastery involves understanding your chosen EA inside-out, optimizing settings for peak performance, and learning how to leverage its features within the confines of a prop firm’s trading rules.

Setting Up Your Trading Environment

To effectively set up your trading environment, establishing a foundation that supports the specific demands of high-frequency trading is essential. Algorithmic optimization and technological sophistication are crucial elements that ensure your trading strategies unfold seamlessly without hitches.

A robust virtual infrastructure, such as a reliable Virtual Private Server (VPS), ensures that trades are executed without delays, providing the low-latency connection needed for HFT activities. In the same way a sprinter would always choose the shortest distance between races, a VPS minimizes the gap between decision and execution.

- Algorithmic Optimization: Adjust settings based on extensive backtesting to tailor responses to market conditions.

- Technical Setup: Employ a cutting-edge VPS to minimize latency and ensure smooth operation.

Implementing continuous monitoring tools ensures trading environments remain optimal by tracking critical performance metrics such as win rates and drawdowns. This constant vigilance helps in early identification of issues, allowing traders to adjust strategies in real-time, similar to a pilot fine-tuning a flight path based on weather changes.

By laying this groundwork, traders are better poised to extract maximum returns from their EAs, ensuring every trade benefits from a well-orchestrated, efficient environment.

Developing Effective Trading Strategies

Developing effective trading strategies involves a continuous process of refinement and adaptation. Much like a sculptor chisels away to reveal an artwork beneath the stone, traders must carve out winning strategies by leveraging market insights and optimizing trading algorithms to match their desired objectives.

Developing your unique trading strategy begins with identifying profitable market opportunities using robust technical analysis tools. Prop trading firms thrive on rigorous data analysis, enabling traders to spot patterns or trends that signify lucrative opportunities. Yet, creating a sound strategy involves more than recognizing patterns; it requires testing its resilience through backtesting and refinement under varied market conditions.

Employing stringent risk management techniques, like setting stop-loss limits and capping position sizes, helps safeguard against adverse market moves. It’s akin to having a safety net in place when performing an aerial act; you’re protected from potential falls. Tools within your trading platform can aid in setting these conditions, giving traders control over potential downsides while maximizing upside potential.

Strategizing with intent and precision enables traders to wield their EAs effectively, ensuring that each opportunity is met with calculated execution for optimal gains.

Maximizing Your Profits and Minimizing Risks

The ultimate objective of utilizing HFT Prop Firm EAs lies in maximizing profits while minimizing risks an art akin to balancing on the tightrope of opportunity and security. Success requires analyzing advanced trading features to fully leverage their potential, ensuring each component of your EA contributes to a profitable trading endeavor.

Advanced Trading Features present significant opportunities for traders. These may include dynamic position sizing, AI integrations for predictive analytics, or real-time trade alerts that enable swift action. Utilizing these features effectively requires keeping a pulse on market conditions, maintaining responsive strategies that adapt to shifting circumstances with agility.

- Stop-Loss and Take-Profit Orders: Protect your capital while optimizing returns.

- Monitoring Market Conditions: Continuously assess and recalibrate as needed.

Protecting your capital is paramount, employing tools such as stop-loss and take-profit orders to guard against excessive losses or lock in gains. Think of it as having a lifeboat ready when sailing on stormy seas; you’re prepared for any scenario, preserving capital through turbulent waters.

By wholeheartedly embracing these risk mitigation strategies alongside maximizing the capabilities of advanced features, traders can thrive in the high-stakes arena of proprietary firm HFT trading.

Overcoming Challenges and Common Pitfalls

Navigating the world of HFT Prop Firm EAs requires overcoming specific challenges and avoiding common pitfalls. These challenges are not unlike a chess game, where a keen eye and strategic moves can mean the difference between success and a missed opportunity.

Prop Firm Challenges and How to Overcome Them

Facing challenges in prop firm trading is an inevitable part of the journey. Common hurdles can include stringent risk management requirements, maintaining consistency with trading strategies, and adhering strictly to firm rules. Successfully overcoming these challenges demands a strategic mindset combined with disciplined execution.

Adopting robust risk management protocols is critical, ensuring that trades remain within acceptable drawdown limits while compelling traders to avoid over-leveraging. Much like a commanding general, a successful trader knows when to advance, retreat, or hold position, preserving strength for critical moments.

Additionally, cultivating consistent strategy application and psychological discipline develops resilience against emotional trading that could otherwise derail objectives. Establishing defined daily routines and clear goals prevents negatively charged decisions while enhancing focus on reaching target outcomes.

By adhering to both prop firm guidelines and strategic innovations, traders can effectively navigate difficulties and emerge victorious with discipline, precision, and determination.

Avoiding Common Mistakes with HFT Prop Firm EAs

Avoiding pitfalls in HFT trading is vital in maintaining the integrity of your trading practices. Many traders have stumbled by misunderstanding prop firm rules or failing to thoroughly test their EAs, leading to costly repercussions that could have been avoided. Navigating these potential minefields requires careful analysis and an unwavering commitment to precision.

Comprehensive pre-evaluation testing and backtesting help in uncovering vulnerabilities within any EA’s framework. These preliminary steps are akin to rehearsing before a grand performance, ensuring that each element acts in concert under live trading conditions.

It is also imperative to establish a documented risk management plan, maintaining records of trade activities, EA settings, and performance metrics. Like a ship’s logbook, having detailed documentation ensures accountability and aligns with firm expectations, guiding successful operations without guesswork.

Finally, fostering emotional intelligence cultivates the discipline needed to withstand adverse events without impulsive decision-making. By aligning these approaches with a well-organized trading regimen, traders will circumvent common mistakes, aligning execution with ambition.

Conclusion

Embarking on the high-octane journey of HFT trading within proprietary trading firms is a thrilling venture that promises substantial rewards to those who are well-prepared. By understanding the defining features of HFT Prop Firm EAs and meticulously selecting and strategizing their use, traders can harness these powerful tools to gain a competitive edge. Mastering this trading form’s intricacies requires not just superior algorithmic systems but also robust risk management, strict discipline, and foresight in anticipating and addressing challenges. By building upon the foundations laid out in this guide, traders stand to maximize their financial gains while minimizing potential risks, paving their path to success.