SMC NEW EA MT5 Unlimited

$399.00 Original price was: $399.00.$29.99Current price is: $29.99.

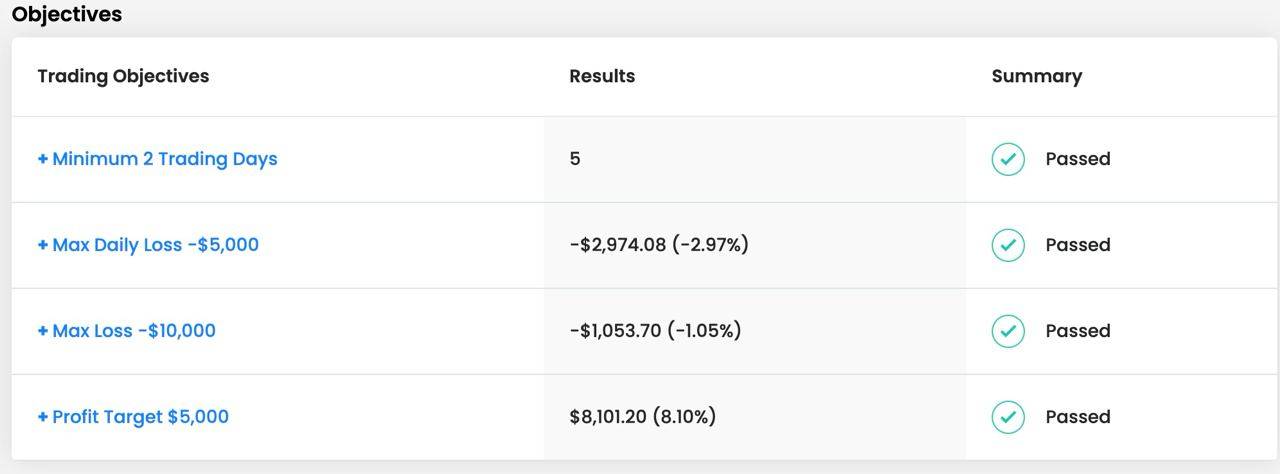

SMC NEW EA stands out as a cutting-edge forex robot and indicator package, specifically engineered to conquer prop firm challenges and thrive in live account trading.

The package includes:

+ Expert: SMC NEW EA (.ex5)

+ Indicator

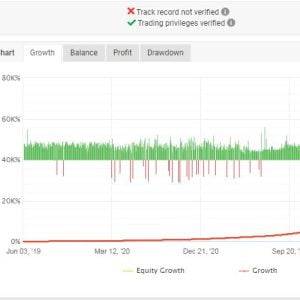

Website/Results:

+ https://t.me/cashcartelea

Note (Important):

This product using custom DLL “msimg32.dll” for MT5 build 4000

Some antivirus may block it and flag it as a virus.

You need to make your antivirus “allow it”

Its a false alarm and its SAFE ,this false alarm is triggered because this is a custom DLL and not verified to any publisher but need to make this product unlocked

SMC NEW EA stands out as a cutting-edge forex robot and indicator package, specifically engineered to conquer prop firm challenges and thrive in live account trading.

Key Features:

- Currency Pairs: Supports ALL Major Pairs

- TimeFrame: M15

- SetFiles: Default

- Minimum Deposit: $100

What is Smart Money Concepts (SMC) Trading?

The Essence of SMC

SMC Forex trading, often buzzing in forex forums and social media, is essentially price action under a new nomenclature. It employs classic forex concepts like supply and demand, price patterns, and support and resistance, albeit with unique terminologies like “liquidity grabs” and “mitigation blocks”.

SMC Philosophy

It’s not just a strategy; it’s a philosophy. SMC posits that market makers, such as banks and hedge funds, play a manipulative role, creating challenges for retail traders. It encourages strategies based on the movements of these ‘smart money’ players.

Origins

Developed by Michael J. Huddleston’s The Inner Circle Trader (ICT), SMC offers both free resources and paid mentorship in Forex trading.

Core Concepts and Terminology

- Order Blocks: A refined concept of supply and demand.

- Breaker and Mitigation Blocks: Terms for support and resistance.

- Fair Value Gaps: Referencing market imbalances.

- Break of Structure (BOS): A key focus in market analysis.

Controversies and Criticisms

Theoretical Flaws

SMC’s major critique lies in its unproven theory that market makers are manipulating patterns to disadvantage retail traders.

Misconception About Trading ‘Like Banks’

Contrary to belief, SMC traders aren’t emulating market makers but are rather aligned with conventional retail trading practices.

Repackaged, Familiar Concepts

SMC essentially rebrands familiar trading concepts, which can be both intriguing and a source of frustration due to the added complexity.

Pros and Cons

Pros

- Proven effectiveness for some traders.

- Solid foundation based on price action principles.

- May offer easier comprehension for some traders.

Cons

- Theoretical aspects may lead to misinterpretation of market dynamics.

- The speculative nature of SMC theories.

- Learning new terminology can be unnecessarily complex.

- Some perceive the marketing of SMC as deceptive.

Final Thoughts: To Trade or Not to Trade Using SMC?

Personal Preference is Key

If SMC’s approach resonates with you, it’s worth exploring. Remember, it’s essentially repackaged price action trading.

Alternatives

For those confused by SMC’s unique jargon or seeking more accessible resources, traditional price action trading is a viable and parallel alternative.

Be the first to review “SMC NEW EA MT5 Unlimited” Cancel reply

You must be logged in to post a review.

Refund Policy:

- Trial Policy: Within the first 3 days of purchase, if you are not satisfied with the product or it does not meet your profit expectations, please provide a valid reason, and we will exchange it for another product of equal or lesser value as a replacement.

- 100% Refund: If the product encounters a technical error from the time you notify us and we confirm that it cannot be fixed, you will receive a 100% refund within 7 days from the date of notification.

- Learn more about our refund policy on the Refund Policy page.

Shipping and Delivery:

The download link will be sent to your email as soon as the order is completed. (No physical products will be shipped to you.)- 99% of products: Delivered within 1 minute after the order is confirmed.

- 1% of products: These are pre-order products, and the download link will be delivered within a few hours to a maximum of 12 hours, or as specified for each product.

Always cautious in trading:

- Forex trading carries high risks, and EAs do not replace personal trading decisions.

- Always thoroughly test tools on a demo account before using them on a live account.

Related products

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

EXPERT ADVISOR

Reviews

There are no reviews yet.