Forex Reviews

5 Top-rated Hft Prop Firm EAs: a Comprehensive Review

5 Top-rated Hft Prop Firm EAs: a Comprehensive Review

In the realm of high-frequency trading (HFT), identifying top-notch proprietary firms and optimal Expert Advisors (EAs) is critical for maximizing profitability. Nova Funding, FTMO, and FundedNext are prop firms renowned for their support of HFT strategies, providing robust platforms for automated trading. These firms enable traders to execute trades with maximum speed through the use of trading algorithms, designed to examine vast datasets and capitalize on market fluctuations. Knowledge of HFT strategies, alongside efficient risk management and an understanding of EA integration, is essential for traders aiming to thrive in this fast-paced trading environment. Nova Funding shines with its unique one-step evaluation process tailored for HFT, whereas FTMO and FundedNext provide attractive funding conditions and technology that leverage the use of advanced EAs. To stay competitive, professional traders explore comprehensive reviews on platforms like Benzinga and Finance Magnates for insights into the evolving landscape of prop trading and to keep abreast of the best HFT opportunities heading into 2024.

Best HFT prop firm eas for maximum profit

Delving deeper into Expert Advisors‘ role in high-frequency trading, we find several key players like Nova Funding, FTMO, and FundedNext, each offering distinct advantages tailored to meet specific trading needs. Their core mission is to facilitate traders in achieving the potential maximum profit by marrying innovative algorithms with superior support. For those in pursuit of capitalizing on swift market movements, the options presented by these firms deserve a thorough exploration, especially their respective profit splits and evaluation processes, which can distinctly impact a trader’s success. To discover more about top-rated EAs optimized for prop firms, click here.

Hft Secret EA: unlocking the secrets of high-frequency trading

The mysterious allure of the HFT Secret EA lies in its ability to transform high-frequency trading into a streamlined process, revolutionizing how trades are executed in volatile markets. Much like a maestro conducting a symphony, this Expert Advisor orchestrates complex data inputs with precision, unlocking secrets hidden in the frenetic tempo of market activity. At the forefront of innovation, it operates akin to a finely-tuned machine, seamlessly sifting through price discrepancies with the agility of a cheetah on the chase, poised to capture fleeting opportunities.

The HFT Secret EA stands apart due to its strategic focus on rapid execution and agility. Unlike conventional trading methods that are tied down by the shackles of manual oversight, the HFT Secret EA leverages algorithmic proficiency. This enables traders to implement strategies without the encumbrance of emotion, effectively mitigating the inherent risks of impulsive decision-making. Ultimately, EAs like these are the navigators of the digital marketplace, charting courses through the seas of uncertainty with a steady hand.

Critically, traders eyeing the HFT Secret EA should consider its adaptability to different trading platforms like MetaTrader 4 or 5, ensuring seamless integration and performance monitoring:

- Key Features:

Advanced trading algorithms

Fast execution speed

Real-time market analysis and adaptability

Despite its striking potential, selecting the HFT Secret EA demands thoughtful consideration of its synergy with specific prop firms’ criteria for e.g. transaction costs, and risk management frameworks. The balance struck between these factors could define the edge that traders need to stay ahead in the high-stakes arena of automated trading systems.

Nova Funding HFT EA: a powerful tool for consistent gains

Nova Funding‘s HFT EA is a beacon of hope for traders striving for consistent profits in a challenging landscape. Much like a skilled artisan crafting a masterpiece, this EA constructs a sophisticated portfolio aimed at enduring success. Its prowess lies in its ability to analyze microscopic price changes, transforming seemingly negligible discrepancies into significant profits over time.

Designed with the trader in mind, the Nova Funding HFT EA marries technological robustness with user-friendly configurations. It boasts an elaborate set of features that guide users through dynamic market conditions, much like a seasoned guide navigating uncharted terrains. The strength of this EA comes from its adeptness at exploiting rapid market fluctuations, using finely honed algorithms that act as the EA’s sixth sense.

A unique aspect of the Nova Funding HFT EA is its seamless integration within proprietary trading firm frameworks that prioritize algorithmic strategies. This focus ensures that traders are equipped not only with cutting-edge trading tools but also with strategies that align with profit-maximization strategies. Here are a few considerations:

- Attributes:

Risk management tools

Compatibility with various trading platforms

Automated processes for optimal execution

The true charm of the Nova Funding HFT EA lies in its fusion of reliability with strategic depth, enabling traders to remain agile and competitive, irrespective of market downturns. As prop firms vie for technological supremacy, Nova Funding stands as a testament to forward-thinking solutions that anticipate trader needs.

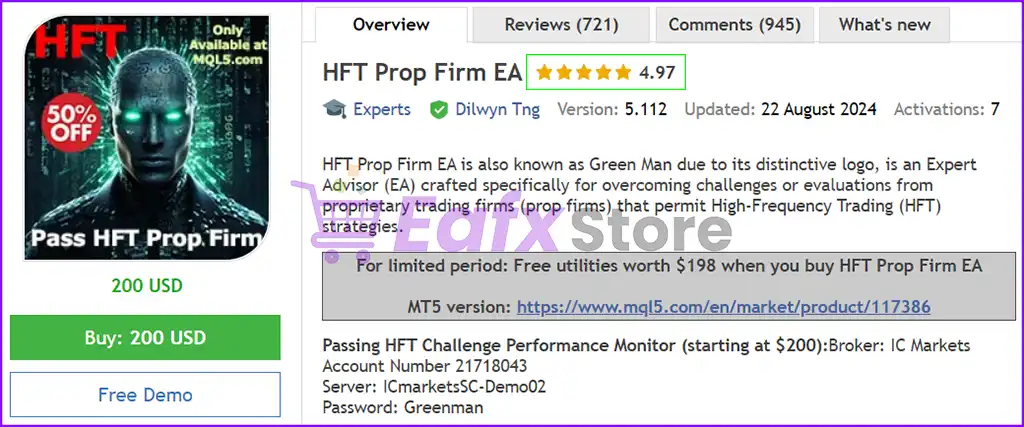

HFT Prop Firm EA: leveraging proprietary trading strategies

Navigating the exhilarating world of HFT Prop Firm EA, traders can feel like they’re harnessing the power of a mighty engine, propelling them forward with the momentum of modern trading strategies. At its core, the HFT Prop Firm EA represents a highly sophisticated approach, turning concepts like proprietary trading into tangible profit-generating systems. This EA serves as the driving force behind prop firms’ trading desks, efficiently channeling operational expertise into real-world application.

The ingenuity of the HFT Prop Firm EA lies in its scalability and performance precision. Just as an architect meticulously designs a resilient structure, prop firms utilize these EAs to withstand the challenges of market volatility, ensuring that strategic positions are handled with expertise. By focusing on high-frequency trades and maintaining swift execution, these EAs cater to the unique demands of prop firms like FTMO and FundedNext.

Moreover, the strategic emphasis of HFT Prop Firm EAs aligns well with algorithmic trading’s future, enhancing their appeal amongst professional traders seeking a competitive edge. The EA’s integration with prop firms enhances its utility, equipping traders with tools finely tuned to meet demanding trading criteria. Among their advantages:

- Advantages:

Extreme precision and low latency

Optimized for prop firms’ funding conditions

Support for high-frequency trade volumes

In the mercurial world of prop trading, the HFT Prop Firm EA elevates the prowess of its users, transforming the landscape with cutting-edge strategies and access to real-time trading intelligence. This potent combination acts as both shield and spear, safeguarding trades while augmenting profit pathways. Bound by both art and science, the HFT Prop Firm EA embodies the apex of automated trading achievements.

US Odyssey US30 EA: dominating the us30 market with advanced algorithms

The US Odyssey US30 EA epitomizes the fusion of strategic foresight and technical acumen that propels traders to unrivaled mastery over the US30 market. As a beacon of trading brilliance, this Expert Advisor weaves advanced algorithms with a finesse akin to a conductor leading an orchestra through a symphonic triumph. In the controlled chaos of the trading floor, the US Odyssey US30 EA conducts its repertoire with assured sovereignty, translating market signals into opportunistic maneuvers.

Foremost among its features is its exceptional capability to consistently deliver outstanding returns through meticulous data analysis and algorithmic precision. A testament to its effectiveness, the EA boasts of navigating market nuances with a Hawk’s eye, capturing fleeting fluctuations that elude less sophisticated counterparts. Its risk management prowess adds another layer, ensuring traders remain shielded from the market’s whims while pursuing their profit targets.

Notably, the US Odyssey US30 EA’s appeal extends beyond mere efficacy, as it is engineered for optimal performance within the architectural confines of prop firm novelties. Drawing on an array of proprietary strategies, it capitalizes on high-equity engagements, ensuring alignment with the revolutionary scalping and day-trading normatives. Hallmark features include:

- Core Competencies:

Adaptation to prop firms’ stringent evaluation metrics

Comprehensive risk assessment protocols

Consistent performance amidst market dynamics

In sum, the US Odyssey US30 EA stands not just as a tool, but as a vanguard of EA innovations in trading the US30 index. With its strategic insights and ability to carve a seamless experience through high-frequency trading avenues, the EA is a valuable cooperative instrument for traders aiming to assert their dominion in the arena of the US30.

HFT Prop EA

The HFT Prop EA stands as a paragon in the intricate world of high-frequency trading, exemplifying the attributes of speed, adaptability, and intelligence. Like a chess grandmaster, it calculates its moves far in advance, crafting strategies that ensure victory in the volatile market arena. This EA is crafted not merely as a tool but as an extension of the trader’s strategic psyche, critically analyzing vast pools of data to offer precision-based trading solutions.

Its design hinges on its capability to swiftly capitalize on minuscule market inefficiencies, converting minute changes into substantial gains. In the rapid exchange of currency or assets, the HFT Prop EA mirrors the elegance of a dancer who effortlessly anticipates and steps through any market pivot. It comprehensively embraces the requirements of modern trading by providing features that minimize manual intervention while maximizing market opportunity.

What sets the HFT Prop EA apiece is its commitment to facilitating profitable trading experiences across a multitude of platforms. Compatibility with major trading interfaces such as MetaTrader releases its full potential, granting traders seamless access to potent high-frequency trading methodologies. Its defining qualities include:

- Distinct Traits:

Built-in adaptability to variable market conditions

Integration with prominent proprietary trading paradigms

Customization options for nuanced trading strategies

Thus, the HFT Prop EA is not just a utility but a gateway for traders seeking to harness the full potential of high-frequency trading in prop firm environments. Crafting a narrative of reliability and efficiency, it emboldens traders to achieve a profound competitive edge, as they navigate and master the mercurial domains that make high-frequency trading a lucrative endeavor.

How to choose the right hft prop firm ea

Selecting the right HFT prop firm EA is paramount for traders aiming to tap into the full potential of high-frequency trading. As we evaluate the leading players like Nova Funding, FTMO, and FundedNext, emphasis should be placed on critical factors such as performance, risk management, and compatibility with trading platforms. The best EAs are designed to optimize efficiency and minimize risks, offering flexibility to adapt to market dynamics while ensuring seamless integration with trading infrastructures. Understanding how each firm’s EA enhances these components is vital as traders navigate the vibrant HFT landscape.

Discover tips for choosing the right EA in HFT Prop Firm EAs: Your Path to Automated Trading Success.

key factors to consider: performance, risk management, and compatibility

Performance, risk management, and compatibility are the holy trinity of factors that determine the success of an Expert Advisor in the dynamic realm of high-frequency trading. Each variable acts like a crucial gear within a finely-tuned engine, ensuring traders reap sustainable profits while mitigating operational risks.

Successful performance hinges on an EA’s ability to deliver consistent returns, striking a delicate balance between daring opportunity and prudent strategy. In much the same way a seasoned chef measures ingredients with precision, traders must scrutinize metrics like win rate, profit factor, and drawdown to ensure reliability. A robust EA effortlessly navigates the labyrinth of market fluctuations, showcasing resilience through adaptive algorithms that forecast shifts with hawk-like vigilance.

Risk management stands as a bulwark against potential financial calamities. The seamless orchestration of risk tolerance levels, stop-loss orders, and strategic position sizing demonstrates an EA’s capacity to safeguard capital amidst the stormy seas of market volatility. Like the fortification of a castle wall, adaptable safety measures ensure traders remain shielded even during adverse market conditions.

Compatibility functions as the connective tissue binding technology to trading strategy. The EA’s efficacy greatly depends on its seamless integration with trading platforms, real-time adaptability to performance data, and coherence with the firm’s evaluation and operational standards. Essential aspects of compatibility comprise:

- Key Compatibility Factors:

Integration with trading platforms e.g., MetaTrader 4/5

Real-time adjustment and performance tracking

Alignment with firm’s proprietary metrics

Together, these factors work in concert ensuring traders choose a high-frequency trading EA that is well-suited to handling market dynamics, delivering not only profit but peace of mind through expertly managed trades.

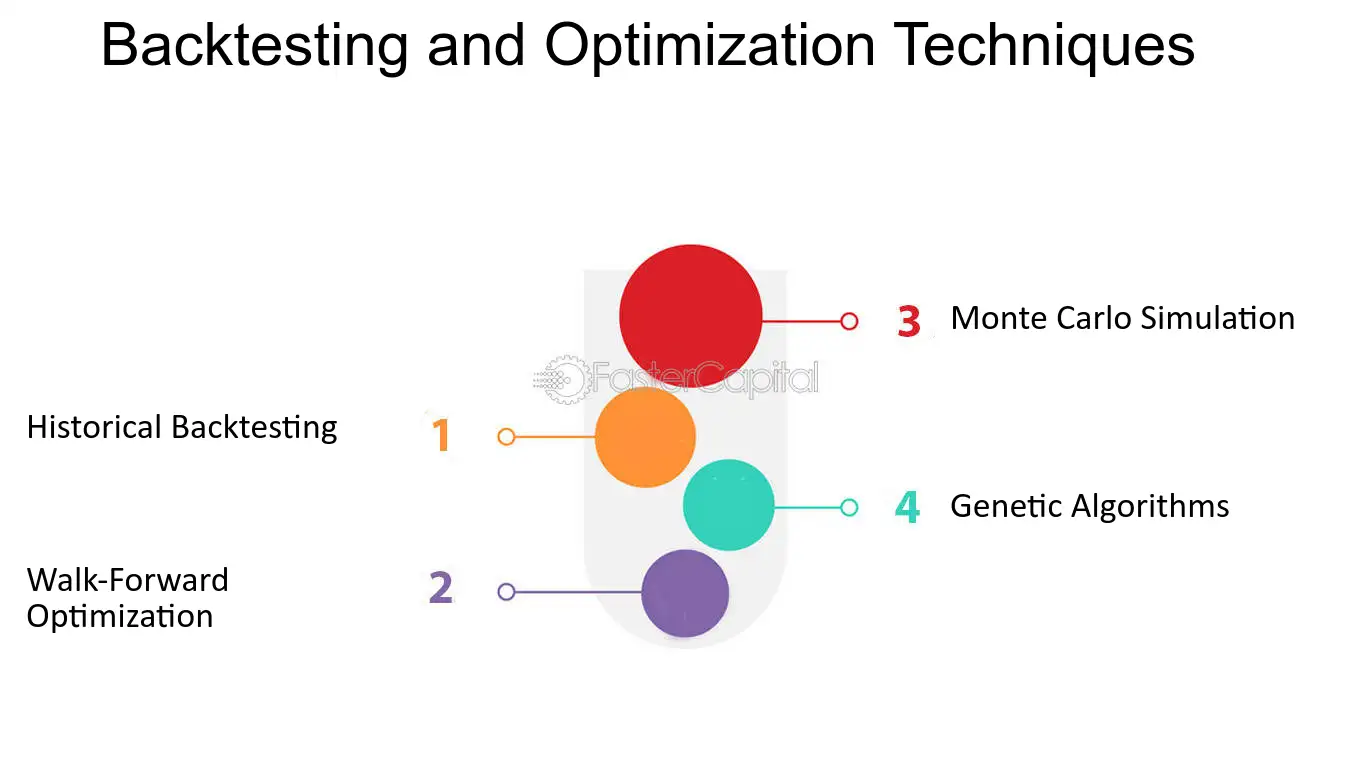

backtesting and forward testing: evaluating ea performance

Delving into the exigent process of backtesting and forward testing provides irreplaceable insights into the meticulous evaluation of Expert Advisors EA performance. Functioning as the investigative probes of trading algorithms, these testing phases peel back layers of complexity inherent in the sophisticated constructs of EAs, uncovering potential strengths and pitfalls.

Backtesting, the retrospective simulation of market strategies using historical data, is akin to unraveling a detective mystery, revealing how EAs would have performed under particular conditions highlights its past moment of glory or failure. With each tap of the keyboard, traders can reconstruct the past, testing hypotheses against authentic market movements while accounting for variables such as transaction costs and slippages. However, traders must be cautious of “curve fitting,” where over-optimized models perfectly match past data but falter in real-world scenarios.

Forward testing, on the other hand, is conducted in real-time using demo account conditions to affirm an EA’s adaptive viability. It serves as the lens that forecasts future performance, enabling an explicit review of an EA’s conduct under present market trends without financial exposure. Together, these methodologies form an essential duo:

- Testing Strategies:

Backtesting – Historical data analysis

Forward testing – Real-time demo assessment

These testing endeavors illuminate the EA’s capacity to affront the unpredictable tides of market scenarios, ensuring traders can opt for solutions that promise not just ephemeral triumphs, but sustained victories encompassing future market narratives.

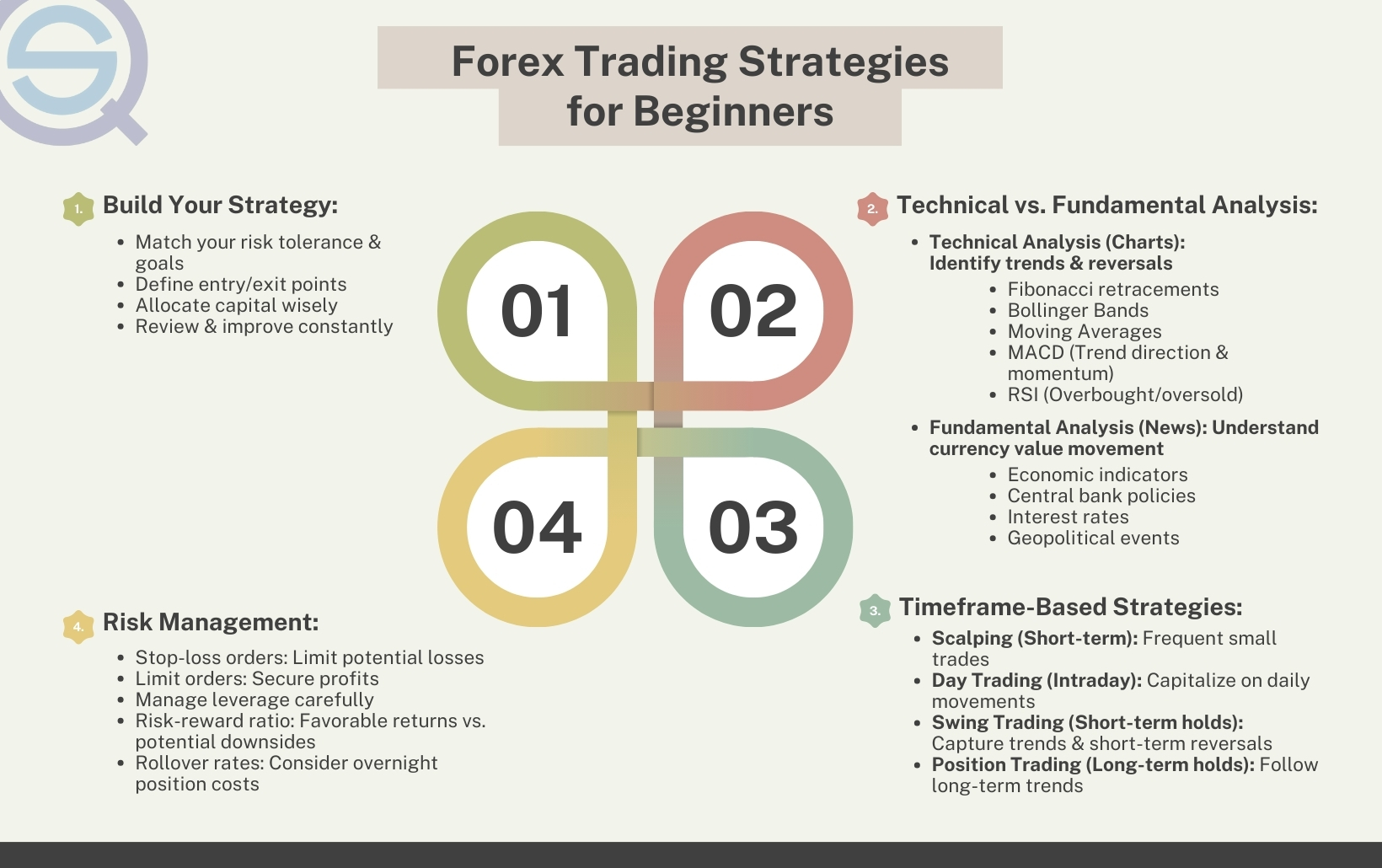

understanding hft strategies: scalping, day trading, and swing trading

Exploring the multifaceted array of HFT strategies, including scalping, day trading, and swing trading, opens up a world where each strategy is akin to a unique choreography in the intricate dance of trading. These high-frequency strategies offer diverse pathways for traders to navigate the bustling tableau of markets, each with its distinct tempo and rhythm.

Scalping, for instance, is the rapid fire of trading tactics, exemplifying speed and precision in a ballet of fleeting trades. Scalpers aim for ‘just-in-time’ profits, darting in and out of positions to capitalize on minute price changes. This approach requires a deft hand operating at warp speed, ensuring that lightning-fast decisions reap targeted rewards.

Day trading, comparable to a sprint through a revolving door, zeroes in on executing a multitude of intra-day trades without holding positions overnight. This tactical pursuit is all about deriving profit from the day’s price fluctuations, allowing traders to seize short-term opportunities in a reasonably volatile landscape.

Swing trading, in contrast, dances to a longer cadence, positioning itself more strategically to capture larger price movements typically spanning days to weeks. This method bridges the gap between rapid consumption and prolonged engagement, demanding a comprehensive analysis of market conditions in its quest for potential rewards.

- Strategy Overview:

Scalping – Quick trades and fleeting gains

Day Trading – Intra-day opportunities

Swing Trading – Patience for larger shifts

Together, these strategies illuminate a spectrum of possibilities for traders aiming to finesse their high-frequency trading pursuits. Those adept at matching the strategy with market temperament stand to gain the upper hand in leveraging their chosen arenas for success.

Top hft prop firms offering high-quality eas

The ability to choose strategic partners via top HFT prop firms can significantly boost trading proficiency. Assessing firms like FTMO, FundedNext, or Funded Trading Plus ensures traders can leverage institutional-grade resources. Each firm offers unique benefits, including extensive funding models and trading instruments suited to high-frequency trading, which can be the difference-maker in volatile markets. By understanding the nuances of what makes each firm thrive, traders are better positioned to maximize their trading potential and secure substantial advantages in the high-stakes arena of prop trading.

ftmo: a leading name in prop trading

FTMO stands as a colossus in the citadel of proprietary trading, impressively known for its robust evaluation processes and the ample opportunities it presents for traders. Much like a towering lighthouse guiding mariners in tumultuous seas, FTMO shines a bright light on the pathways for traders navigating the complex waters of high-frequency trading with confidence and clarity.

This Prague-based firm puts aspirants through the wringer with its rigorous, yet fairly structured two-step challenge designed to authenticate trading dexterity and strategic coherence. Such a process is akin to a rite of passage, ensuring that only those of unwavering discipline and exceptional skill harness their potent trading environment. FTMO encourages the use of automated systems like EAs, thereby harmonizing human expertise with algorithmic precision.

A few standout features include their extensive array of trading instruments and the opportunity for traders to manage significantly funded accounts up to $2,000,000. Coupled with profit splits reaching up to 90%, FTMO provides a compelling incentive for traders seeking to amplify potential gains while retaining a fair share of profits. Noteworthy aspects encompass:

- FTMO Highlights:

Comprehensive trading instruments Forex, indices, etc.

In-depth performance feedback

Robust evaluation methodology

FTMO’s steadfast commitment to nurturing an enlightened trading community, complemented by its educational resources and ongoing support, renders it a formidable partner for those looking to leverage high-frequency trading strategies effectively. As traders operate within its structure, they find themselves emboldened by the resources to focus on innovation and sustained growth.

fundednext: empowering traders with flexible funding

FundedNext heralds a new dawn for traders by delivering an abundance of flexible funding models devised to cater to varying skill levels and trading needs. Like a nurturing garden, FundedNext provides fertile ground for budding traders and seasoned experts alike, enabling their financial aspirations to blossom with the right mix of motivation, resources, and opportunities.

Since its inception in March 2022, FundedNext has opened the gates wide, initially providing capital amounts from $5,000 to $200,000 with the potential to scale this up to a generous $4 million as trading prowess becomes evident. This scalable structure is reflective of their commitment to empowering traders, empowering them to grow at their own pace, much like a gardener tending to their flourishing landscape.

The diverse challenge models offered by FundedNext Evaluation, Express, and Stellar cater to various financial appetites. Offering up to a remarkable 95% profit split, traders have immediate earning prospects from the onset, providing not only capital but also an incentive for success. The alignment with advanced trading platforms like MetaTrader only serves to enhance this further, offering:

- Noteworthy Elements:

Flexible scaling and funding options

Robust technology platforms for EAs

Profit sharing models up to 95%

In essence, FundedNext stands as an enabler, offering traders not just financial resources but a springboard for innovation and success within high-frequency trading’s strategic domain. By aligning with the ethos of nurturing talent and providing flexible funding, it stands poised as a key player shaping prop trading’s evolving landscape.

funded trading plus: a comprehensive prop trading solution

Funded Trading Plus encapsulates a vision of comprehensive support for traders, artfully merging coherent proprietary strategies with innovative funding solutions. Like the paints on an artist’s palette, Funded Trading Plus provides traders with a rich selection of financial tools and resources, enabling them to craft their narrative of trading success with creativity and precision.

This prop firm positions itself as a dynamic interface, where intuitive structures and sophisticated funding models are as integral as the brush strokes of a masterpiece. With a tailored portfolio of options, from low-cost challenge entry points to expansive funding allowances, traders find ample room to maneuver and explore deliberate strategies within HFT and beyond.

A prominent feature of Funded Trading Plus is its adeptness at providing structured support systems, facilitating trade execution, and ensuring thorough risk management oversight. This fosters a trading environment that feels as much like a mentorship as it does a financial partnership, with:

- Key Components:

Holistic trader support system

Diverse challenge models

Structured approach to risk and rewards

In the spirit of fostering a seamless transition from novice to expert, Funded Trading Plus delivers not just capital but an ecosystem that emphasizes growth, adaptability, and resilience. For traders drawn towards high-frequency trading’s pulse and potentials, it offers a canvas upon which to paint their achievements, leveraging enriched support to yield precise and effective trading outcomes.

Maximizing your profits with hft eas

To maximize profits in the prop trading landscape with HFT EAs, understanding the interplay of risk management, strategic adaptation, and settings optimization is critical. Knowledge about the nuances of top-tier firms such as FTMO, FundedNext, and Funded Trading Plus provides insights into the art of balancing high returns with carefully managed risks. This involves leveraging effective risk management techniques to protect capital, fine-tuning EA parameters for optimal settings, and maintaining a culture of continuous learning to stay ahead. Mastery of these elements helps traders achieve success while navigating the complexities of HFT in prop trading.

effective risk management techniques: protecting your capital

Implementing effective risk management techniques is akin to constructing a solid dam that guards against financial inundation. In the prism of high-frequency trading, where the torrents of potential gain are matched by the depths of possible loss, risk management is the unshakable foundation upon which sustainable profit is built.

Advanced techniques such as diversification come to the forefront, allowing traders to deploy a mosaic of strategies that reduce exposure to any single point of failure. By using a portfolio of EAs, each designed to perform under different market conditions, traders shield themselves from existential threats that could topple solitary strategies.

Equally, the disciplined application of position sizing and leverage control reflects the strategic mentality of chess a game where every move is calculated not only to seek victory but to prevent defeat. By aligning trade sizes with overall capital, traders avoid overexposure to any single trade, while managing leverage ensures that losses remain manageable.

Complementing these methods, regular monitoring and adaptation of trading strategies is imperative. Markets are entities of change, but by keeping a constant eye on EAs so-called “artificial traders,” and tweaking their settings as necessary, traders maintain an edge.

- Risk Management Strategies:

Diversification through multiple EAs

Prudent position sizing and leverage control

Continuous performance monitoring and adjustment

These techniques underscore the need for vigilance and foresight in navigating the turbulent waters of HFT. Through dedicated effort and a mindset of risk aversion, traders craft a resilient portfolio capable of withstanding market vicissitudes while reaping potential gains.

optimizing ea settings: fine-tuning for optimal performance

Optimizing EA settings is the pursuit of refining an intricate machinery to its zenith, where every gear and lever must be perfectly calibrated to achieve optimal performance. The essence of high-frequency trading often rests on the precision of such fine-tuning, ensuring EAs not only run efficiently but magnify profit potentials in fluctuating market terrains.

Tune-up begins with an intimate understanding of trade-specific strategies inherent in the EA, which act as the blueprint guiding every adjustment. Just as a conductor ensures that each instrument in the orchestra complements the other, coordinating stop-loss and take-profit levels aligns the EA with market rhythms. Determining the right frequency for trades requires backtesting against historical data, a process as vital as refining clay into a masterpiece.

Another phase of this iterative process emphasizes customization to ensure the EA adapts dynamically to evolving market conditions. Utilization of automated tools for real-time market analysis enhances responsiveness, enabling quick recalibrations that resonate with current market tendencies.

- Settings Optimization Overview:

Understanding and tailoring strategy adaptations

Incrementally backtesting before finalizing settings

Real-time analysis and adjustment tools

These optimized settings hold prime importance in unlocking the EA’s full potential, empowering traders to leverage algorithmic power while maintaining flexibility in the face of evolving market conditions. The journey to mastery demands continuous tuning and evaluation, culminating in an EA that operates as an efficient and profitable extension of the trader’s brainwork.

continuous learning and adaptation: staying ahead of the curve

Thriving amidst the relentless pace of high-frequency trading requires an unwavering commitment to continuous learning and adaptation. Traders find themselves in a quest, not entirely dissimilar to scholars on the path of discovery, perpetually assimilating new market insights and strategies to maintain preeminence over evolving landscapes.

The dynamic nature of financial markets means they are in constant flux, mirroring a living ecosystem wherein shifts are rapid, and anomalies could emerge unannounced. Forward-thinking traders delve into market trends, economic indicators, and geopolitical events equipping themselves like seasoned sailors plotting new courses based on ocean currents and weather patterns.

Engaging with trading communities and forums opens up platforms for exchanging insights, nurturing a mentorship-like environment where traders learn from shared experiences. This collective intelligence acts as a crucible, fostering innovation while honing established practices.

- Elements of Continuous Learning:

Engagement with educational resources and courses

Participation in forums and communities

Regular reviews of EA performance and settings

The lifeblood of trading lies in the agility to adapt, pivot, and redefine approaches in response to new variables. Embracing continuous education empowers traders to push boundaries, experimenting with leading-edge EAs and strategies that remain responsive to market changes, ensuring they consistently stay ahead of the curve.

Common pitfalls to avoid when using hft eas

When maximizing profits with HFT EAs, awareness of common pitfalls is essential to safeguard trading ventures from unnecessary risks. Overtrading, emotional decision-making, and neglect of key protocols can entangle even experienced traders. As these pitfalls can lead to significant account drawdowns, it’s crucial to uphold risk management, remain disciplined, and maintain robust EA performance evaluations in the face of unpredictable market conditions. Through a strategic approach to HFT, these challenges can be mitigated, ensuring a fortified trading journey that aligns well with the inherent complexities of high-frequency trading.

overtrading and emotional decision-making: the dangers of impatience

In the exuberant world of high-frequency trading (HFT), overtrading and emotional decision-making loom large as Sirens luring traders onto the jagged rocks of financial ruin. At its core, overtrading conveys the human tendency to engage in a hyperactive flurry of transactions buoyed by impulse instead of reasoned strategy, akin to a gambler frantically placing bets in a ******.

The temptation begins innocuously, driven by market volatility and the allure of chasing quick profits. However, this impulse often breeds impatience, leading traders to forsake carefully laid trading plans in the heat of the moment. It’s a cavalcade of unchecked trades, reminiscent of a fever pitch, where instead of strategic finesse, decisions hinge on gut reactions exacerbated by fear and greed.

The antidote to this self-sabotaging trap lies in cultivating emotional discipline and patience. Just as martial artists harness chi to maintain equilibrium amidst chaos, traders can adhere to a robust trading plan, reinforced by pre-set criteria, methodical risk management, and stringent stop-loss orders to golf their emotional meter.

- Strategies to Overcome Impatience:

Diligent adherence to the trading plan

Implementation of automated safeguards

Regular strategy revision and feedback loops

By prioritizing emotional stability while strategizing, traders cloak themselves with rational judgment, ensuring that each trade is not merely a leap into the unknown, but a calculated advance toward sustainable profitability.

ignoring risk management rules: protecting your account balance

Ignoring risk management rules is akin to steering a ship without navigation uncertainty plastered onto the fearsome canvas of financial unpredictability. In high-frequency trading, the gravity of adhering to risk management protocols cannot be overstated, as it’s not merely about gains, but the safeguarding of one’s trading capital against unforeseen market surprises.

Risk management constitutes boundaries within which traders operate securely. It involves setting loss limits akin to the guardrails on a mountain road, protecting traders from veering into the abyss of significant drawdowns. Critical to these rules is the establishment of stop-loss orders, position sizing, and broader shielding measures.

Many traders find themselves in tenuous situations by neglecting the risk tolerance tailored to their specific financial scenarios, which exposes their account balance to potential adversity. Like a house built on sand, without foundational risk management, no amount of profit can withstand the storms of swift and unpredictable shifts.

- Protective Practices:

Utilization of stop-loss orders

Position sizing aligned with capital risk tolerance

Regular market condition analysis for pre-emptive adjustments

By steadfastly implementing robust risk management rules, traders construct a financial barrier against uncertainty. Upholding these rules enables an account balance to thrive untouched by catastrophic losses, ultimately contributing to long-term profitability and trading success.

lack of proper backtesting and optimization: setting yourself up for failure

The absence of rigorous backtesting and optimization serves as an Achilles’ heel for traders, akin to launching a spacecraft with crossed fingers rather than calculated precision. These practices play a foundational role in gaming the odds of HFT success, as they uncover performance reliability while fine-tuning EAs to meet diverse scenarios.

Backtesting empowers traders by offering a retrospectively grounded view, simulating how strategies might respond in varied historical market conditions. Even as we unearth potential gains, the importance of accounting for transaction fees, slippage, and real-world “bumpers” in the backtesting model is essential, akin to considering all obstacles during a marathon.

However, many traders fall prey to the allure of a backtest portfolio decked in gilded stats. This mindset coaxes them into over-optimization, creating a “curve-fitted” strategy that only excels under historic data but falters under present market dynamics. By fortifying analyses with forward testing and employing a compartmentalized approach, traders help ensure adaptability.

- Testing Methods:

Comprehensive backtesting across diverse conditions

Avoidance of data snooping biases for precise results

Forward testing for modern alignment

Through attentive backtesting and optimization, traders architect resilient strategies capable of adapting as market conditions evolve. It aligns the EA’s goals with performance fidelity and reality, ensuring there are no unwanted surprises embellishing what would otherwise be a robust EA trading journey.

The future of hft trading: ai and machine learning

Having traversed the pitfalls associated with maximizing profits with HFT EAs, the future of high-frequency trading lies in the synergy between artificial intelligence (AI) and machine learning (ML). These fascinating developments signal a new era, where traders are equipped to navigate complex market shifts with unparalleled precision and foresight. The integration of AI transforms Expert Advisors with adaptive algorithms, creating dynamic systems that continually learn and refine strategies. As trading ecosystems evolve, ethical considerations will guide AI practices to maintain market integrity while capitalizing on technological advancements in proactive new-age trading landscapes.

ai-powered eas: the next generation of trading technology

AI-powered EAs represent a transformative leap in trading technology, infusing them with an intelligence that’s perhaps best compared to an artist finding beauty within the chaos of canvas splatters. These algorithms go beyond simplistic pattern recognition by tapping into neuro-network computing processes that mimic human cognition yet remain immune to human error.

With the advent of AI, EAs are ushered into an era where they evolve from reactive systems into proactive entities operating with profound comprehension of market complexity. As they process colossal streams of data in real-time, AI-powered EAs respond with precision akin to seasoned traders analyzing myriad charts within milliseconds, sculpting patterns into coherent profit-driven actions.

The core strength of AI is its ability to refine itself continuously. Just as nature informs evolution, AI imbibes from cumulative experiences, employing reinforcement learning to craft and re-craft strategies. This results in an unparalleled ability to adapt dynamically in response to the vicissitudes of market fluctuation.

- AI-Powered Advancements:

Real-time data processing and analysis

Reinforcement learning-based strategy enhancements

Integration with advanced trading platforms

Ultimately, the emergence of AI-powered EAs signifies a new dawn for traders, marking the intersection where technology enhances intuition, bringing strategies to life in an unpredictable environment. As they propel trading strategies into new dimensions, the potential for maximizing profit is enriched through these intelligent equilibriums.

machine learning algorithms: adapting to market dynamics

Within the burgeoning expanse of high-frequency trading lies the influence of machine learning algorithms, a technological marvel not unlike the evolutionary journey of the Grand Canyon a masterwork continually sculpted by natural forces. These algorithms absorb streams of market data with a similar dynamism, evolving as they digest fresh inputs and adapt to shifting dynamics instantaneously.

Machine learning extends beyond merely predicting price fluctuations; it encompasses a comprehensive understanding of market conditions. By weaving together vast swaths of historical and real-time data, these algorithms serve as veritable geomancers of the financial landscape. This understanding enables them to anticipate patterns, honing decisions with each iteration.

With the aid of supervised and unsupervised learning techniques, machine learning systems discern hidden relationships within data, formulating strategies that directly correlate to profitability and risk management. This adaptability speaks volumes about their function:

- Features of Machine Learning in HFT:

Dynamic data integration for evolving strategies

Real-time analytics and execution within microseconds

Enhanced risk assessment through statistical insights

The symbiosis between HFT and machine learning generates a paradigm that melds instinct with quantitative precision, enhancing the art of trading with science’s objectivity. Together, they form a formidable partnership, increasing the chances of successfully navigating the challenges presented by the market’s ceaseless progression.

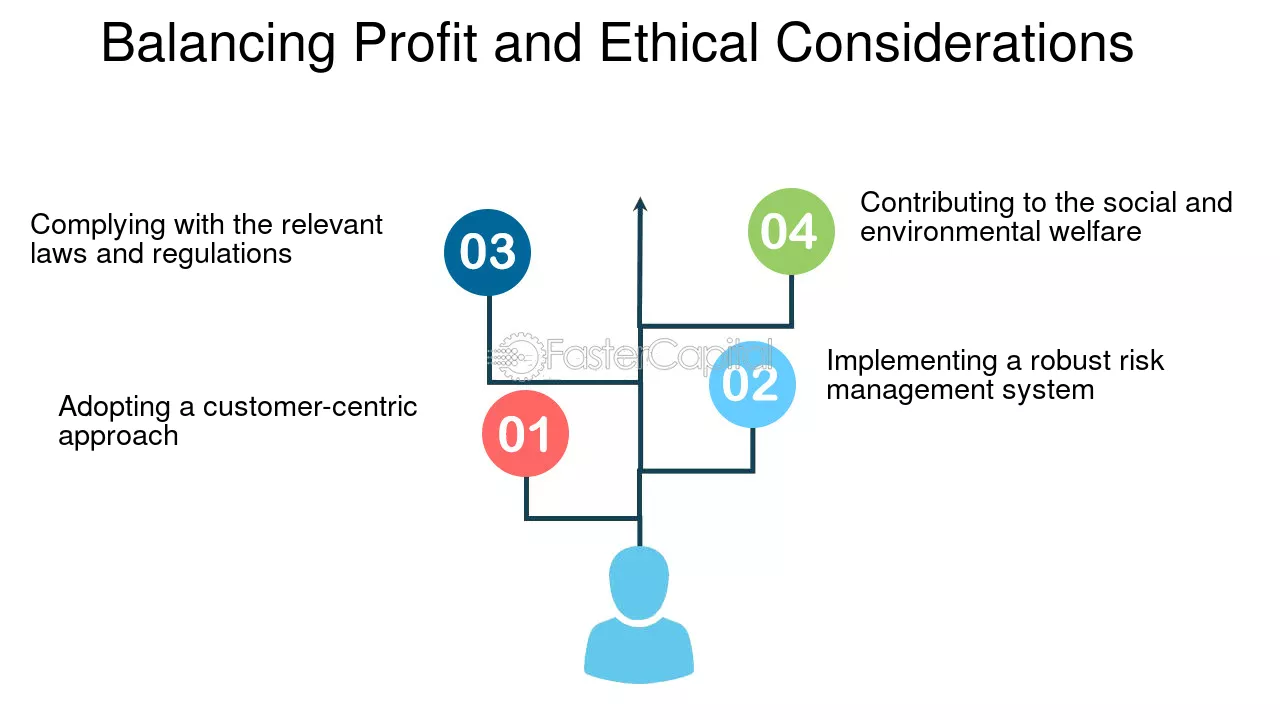

ethical considerations in hft: balancing profit and responsibility

In the realm of high-frequency trading, where technology marches briskly, ethical considerations stand as the compass guiding traders toward integrity a lodestar in an ever-expanding universe of possibilities. As AI and machine learning systems burgeon with capacity, the line demarcating profit and responsibility comes under scrutiny, necessitating a conscientious approach.

Market manipulation remains a looming concern. Practices such as “quote stuffing” and creating artificial market conditions challenge both legal frameworks and ethical norms, provoking deliberations on the fine balance between exploitation and fair competition. The specter of asymmetric advantages prompts the imperative for rigorous oversight and transparent practices.

To engender trust, firms must champion an ethos of transparency, adopting responsible AI frameworks that ensure market integrity remains inviolate while pursuing profitability. As stewards of ethical practice, regulators and market participants bear an equal responsibility to maintain vigilant oversight, fostering fair play and overcoming distrust.

- Guiding Ethical Principles:

Transparent practices and responsible AI usage

Equitable trading standards across market participants

Engagement with regulators to ensure integrity

In embracing these principles, HFT practitioners align with a future where ethical considerations are foundational preserving a market that welcomes innovation, upholds accountability, and thrives within an agreed framework of responsibility and trust.

Conclusion

In conclusion, staying competitive in the future of high-frequency trading necessitates a thorough understanding of Expert Advisors, the leveraging of cutting-edge prop firms, and an integration of AI and machine learning technologies. As traders navigate this dynamic landscape, the importance of disciplined risk management, proper backtesting, strategic adaptability, and ethical considerations comes to the forefront. Mastery of these elements not only unlocks the potential for substantial profit but ensures navigational safety in the choppy seas of high-frequency trading. An amalgamation of past lessons and future innovations sets the stage for a thriving trading ecosystem that is both profitable and responsible.