Tutorial

High-frequency Trading HFT: Build Your Forex Bot Mastery

How to build a high-frequency trading bot

In the fast-paced world of financial trading, high-frequency trading (HFT) stands out as a method that leverages speed and advanced computational algorithms to capitalize on small price discrepancies across various markets. As the domain of HFT evolves, understanding the core mechanisms behind building an HFT bot can offer significant advantages to traders. Whether you’re an institutional player or a committed individual trader, grasping the intricacies of HFT its technologies, potential risks, and rewards is crucial. This guide seeks to provide in-depth insights into the various components and strategies involved in creating a successful HFT bot, focusing particularly on the Forex market.

Understanding high-frequency trading

High-frequency trading is a remarkably intricate yet highly rewarding method in the financial markets, marked by the rapid execution of trades through sophisticated algorithms. These trades happen in high volumes and at incredible speeds, often in microseconds, aiming to profit from minimal price discrepancies. With its operations heavily reliant on cutting-edge technology, blazing fast data processing, and real-time decision-making, HFT is a fascinating demonstration of where finance meets high-tech innovation.

What is high-frequency trading?

High-frequency trading (HFT) is a specialized form of algorithmic trading distinguished by executing a multitude of orders at extraordinary speeds typically measured in microseconds. At its core, HFT relies on complex algorithms designed to detect and exploit fleeting market inefficiencies and price discrepancies. Think of it as financial markets where split-second decisions can translate into substantial profits or losses, akin to a chess game played at lightning speed where each millisecond counts.

HFT mainly involves strategies such as statistical arbitrage, market making, and momentum trading. Unlike traditional trading methods, HFT trades across various asset classes, including equities, options, futures, and Forex, at lightning speeds, executing thousands of transactions per second. This high velocity allows traders to take advantage of transient market movements that are undetectable at slower speeds.

The core components of an HFT system include:

- Ultra-fast hardware: To reduce latency, HFT firms utilize top-tier computer systems.

- Advanced algorithms: These are capable of analyzing numerous variables and data points in real-time.

- Direct Market Access (DMA): This provides lightning-fast trade execution by connecting directly to exchanges without intermediaries.

- Co-location services: These minimize latency by allowing traders’ servers to be physically close to exchange servers.

However, while HFT enhances market efficiency by providing liquidity, it can also escalate volatility, especially during sudden market movements, and has been subject to increased regulatory scrutiny due to concerns about fairness and market manipulation. The world of HFT is thus depicted with both robust opportunities and significant challenges, echoing the age-old adage: great power comes with great responsibility. Yet, as technology continues to advance, the potential for retail participation in HFT once the domain of institutional investors grows, albeit within strict technical and financial confines.

Definition and core concepts

High-frequency trading is defined by high-speed trade execution to profit from market inefficiencies. It is characterized by minimal holding periods and requires sophisticated technology and high-speed internet to achieve.

How HFT works: a step-by-step guide

HFT involves:

- Data Acquisition: Gathering real-time market data through direct market feeds.

- Signal Generation: Using algorithms to identify trade opportunities by analyzing patterns and trends.

- Execution: Implementing trades based on algorithm signals using DMA.

- Risk Management: Monitoring trade exposure and capital risk in real-time.

Key components of an HFT system

Essential HFT components include:

- Algorithms: For trading signal development and execution.

- Servers and Co-location: High-powered servers along with physical proximity to exchanges to reduce latency.

- Network Infrastructure: Low-latency networks to ensure fast data transmission.

- Monitoring Systems: For real-time analysis and performance tracking.

The benefits and drawbacks of HFT

High-frequency trading comes with remarkable advantages and significant drawbacks. One of the standout benefits of HFT is the unparalleled speed it offers. By engaging in trades at speeds that often escape traditional one-on-one trading scenarios, HFT allows traders to capitalize on momentary price movements that can yield notable profits, almost like striking gold during a high-speed treasure hunt. This effectively translates into improved liquidity across the market, as HFT continuously executes transactions, thus narrowing bid-ask spreads and enhancing market fluidity.

In contrast, the practice of HFT does come with a fair share of drawbacks. For instance, technological complexity is a significant barrier, with the requisite systems being both sophisticated and expensive, making HFT largely the territory of institutional investors and well-resourced trading firms. Furthermore, HFT intensifies regulatory scrutiny due to concerns over potential market manipulation and unequal advantages. Consequently, this can lead to increased scrutiny, where strategies might face alterations due to evolving regulations.

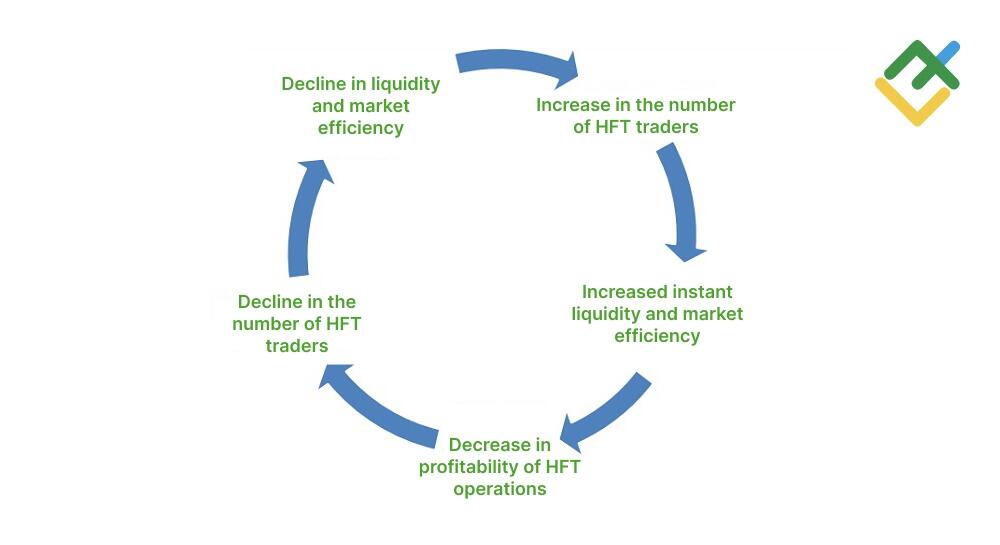

On the flip side, HFT might amplify market volatility, with rapid trade executions sometimes causing sudden spikes in market activity think of it like a high-stakes ***** game where a flurry of activity can sway the outcome dramatically. While some traders regard this as an opportunity, others see it as a risk, particularly during periods of market stress. This increased competition also leads to thinner profit margins, demanding more sophisticated strategies to sustain profitability.

Benefits of HFT:

- Speed: Can execute trades at fractions of a second.

- Liquidity: Increases market liquidity through continuous trading, reducing spreads.

- Lower Transaction Costs: High volume trading often leads to lower commissions.

- Reduced Human Error: Automated executions bypass human emotions, allowing rational decision-making.

Drawbacks of HFT:

- High Infrastructure Costs: Requires costly setup and maintenance of high-speed, low-latency systems.

- Regulatory Pressure: Subject to evolving regulations and scrutiny for potential market manipulation.

- Market Volatility: May escalate during sudden spikes in trading activity.

- Increased Competition: Pressure on profit margins due to numerous HFT participants.

In summary, while HFT poses impressive benefits in terms of market liquidity and cost efficiency, participants must navigate its drawbacks thoughtfully, ensuring robust risk management and compliance frameworks are in place. Such balance is essential for maintaining success in the HFT space.

Building your HFT bot: a practical guide

Understanding high-frequency trading is pivotal before venturing into the creation of an HFT bot. This knowledge will enable you to identify suitable trading strategies and technologies, ensuring your bot operates at peak efficiency. As you embark on this journey, foundational principles will serve as your guiding stars, navigating you through the technical intricacies and market dynamics. Developing an HFT bot necessitates proficiency in coding, market analysis, and risk management all entwined with a strategic approach to trading automation.

Choosing the right programming language

Selecting an appropriate programming language is paramount when building an HFT bot, especially in the Forex market, where precision and speed are non-negotiables. C++ is hailed as a paragon for HFT due to its unmatched ability in performance optimization and low-latency execution traits vital for trading where milliseconds could be the difference between profit and loss. Its efficiency in managing hardware resources gives it the edge, akin to what a high-powered racer’s fine-tuned engine offers in formula racing.

On the other hand, Python emerges as a popular choice for developers, offering an ease of use unparalleled in scripting and extensive libraries that can expedite the development of smart trading strategies. While it may not match C++ in execution speed, Python’s versatility can be a boon during the strategic planning phase, allowing intricate models and simulations to be crafted effortlessly.

Other options, such as Java and MATLAB, come into play as well. Java stands out for its concurrency model, conducive for developing scalable, multi-threaded trading architectures a necessity in markets with high data throughput. MATLAB, while less conventional, provides analytical strengths particularly advantageous for modeling and backtesting strategies, making it a formidable choice within the research phase of HFT bot development.

| Programming Language | Pros | Cons |

|---|---|---|

| **Python** | Easy to use, extensive libraries | Slower execution compared to C++ |

| **C++** | Maximum performance, low-latency | Steeper learning curve, complex syntax |

| **Java** | Strong concurrency support | Moderate learning curve, slower than C++ |

| **MATLAB** | Powerful mathematical computations | Primarily for research, integration with live trading systems can be complicated |

Ultimately, the choice should align with your objectives, trading strategies, and the depth of your technical acumen. Prioritize execution speed for performance-critical stages but leverage user-friendly languages to develop robust strategies and conduct comprehensive simulations.

Python: the popular choice for HFT

Python is well-loved for its simplicity and robust libraries such as NumPy and pandas, which facilitate rapid prototyping and development.

C++: For maximum performance

For the lowest latency and high-speed execution, C++ remains the go-to, offering direct hardware access to optimize performance.

Other options: Java, MATLAB

Java’s scalability and MATLAB’s analytical prowess provide alternative solutions for specific trading and analytics needs.

Designing your trading strategy

Designing a trading strategy is the lifeblood of your high-frequency trading bot. It’s the blueprint upon which the bot’s success will heavily rely. Essential to this phase is a profound grasp of market dynamics and the application of various strategic approaches that can capitalize on fleeting opportunities. Strategies like statistical arbitrage, market making, and event-driven trading can offer distinctive avenues to achieve profitability.

Statistical arbitrage strategies involve capitalizing on price discrepancies across correlated assets, employing algorithms to execute trades once these deviations are identified. The success of such strategies hinges on a profound understanding of statistical models and consistent backtesting to ensure reliability.

Market making strategies focus on providing liquidity by simultaneously posting buy and sell orders. This strategy enables traders to profit from the bid-ask spread, relying on sophisticated algorithms to remain competitive in quoting prices at an advantageous position.

[event-driven strategies] rely on the impact of significant news or market events to alter commodity prices, turning the volatility and adjustments into trading opportunities. Traders must utilize real-time data feeds and powerful analytics to align their trades with anticipated market movements swiftly.| Strategy Type | Description |

|---|---|

| **Statistical Arbitrage** | Exploits price differentials across assets |

| **Market Making** | Profits from bid-ask spread, enhances liquidity |

| **Event-Driven** | Utilizes market-moving events to drive trades |

Furthermore, the design should integrate a reliable risk management framework to ensure stability under varying market conditions. This involves setting explicit rules on entry and exit points, position sizing, and loss thresholds. Moreover, continuous backtesting of the strategy with historical and simulated data will provide crucial insights, highlighting potential weaknesses before going live.

This strategic design phase requires both creative and analytical rigor. A winning strategy is often not just about identifying profitable trades but knowing the timing, execution method, and how to mitigate associated risks. Thus, each strategy needs robust testing cycles combined with dynamic adaptability to respond to market changes swiftly.

Statistical arbitrage strategies

These are predicated on mathematical models to spot price discrepancies between related assets.

Market making strategies

Focus on benefiting from spreads between buy and sell prices through swift execution.

High-frequency news trading

Captures price movements resulting from news releases and executed within milliseconds of data dissemination.

Event-driven strategies

Trades based on anticipated market movements due to specific, impactful events.

Developing your HFT algorithm

Developing the algorithm for your HFT bot is akin to crafting the heart of your trading operation. It’s where the bot’s capacity to efficiently process market data, make intelligent trading decisions, and execute trades at peak speeds coalesces. Designing a robust and efficient HFT algorithm necessitates precision and depth of understanding in both programming and financial markets.

Integral to the process is backtesting and optimization, where algorithms are rigorously evaluated against historical data to gauge their effectiveness and reliability. This phase allows traders to pinpoint strengths and vulnerabilities, making the algorithm battle-ready for real-world conditions. Employing advanced tools for simulation and analysis is crucial to enhance its predictive accuracy and robustness.

Implementing risk management protocols within the algorithm forms another critical component, securing against unexpected market shocks and volatility. By integrating mechanisms that monitor exposure, manage stop-loss orders, and dynamically adapt the strategy to changing markets, traders can mitigate potential financial risks.

The testing and debugging stage is the gateway to identifying and refining any logical errors within the algorithm. This process involves thorough examination and refinement, ensuring the code operates seamlessly and matches the high-speed execution requirements of an HFT environment. This step is imperative before transitioning to live markets, as any oversight can result in costly errors.

| HFT Algorithm Development Stages | Description |

|---|---|

| **Backtesting and Optimization** | Validating algorithm efficiency and reliability through historical data analysis |

| **Risk Management** | Implementing protocols to safeguard against market irregularities |

| **Testing and Debugging** | Identifying and refining errors to ensure seamless operation |

Ultimately, developing the algorithm for your HFT bot entails meticulous craftsmanship and ongoing review. The algorithm should be a harmonious blend of theoretical strategy and practical execution, engineered to sustain the fast-paced dynamism of high-frequency trading.

Backtesting and optimization

Involves fine-tuning the algorithm based on historical data analysis to find the optimal parameter settings.

Implementing risk management

Automation of position sizing, exposure limits, and stop-loss features to manage risk effectively.

Testing and debugging

Critical stages to ensure the algorithm functions flawlessly and accommodates varying market dynamics.

Deploying your HFT bot

Deploying an HFT bot encompasses various logistical and technical considerations that ensure the bot operates seamlessly in the live trading environment. The quest begins with choosing the right hosting provider to house your servers, requiring reliable uptime and low latency that meet the rigorous demands of high-speed trades. Opting for co-located or proximity-hosted servers can significantly enhance execution speeds, putting your bot milliseconds ahead of competitors.

Equally crucial is setting up a resilient trading environment. This involves configuring direct market data feeds, setting trade limits, and establishing fail-safes to prevent critical errors during execution. The architecture of your trading environment should retain agility for rapid adaptations to shifting market conditions, akin to a ship skillfully navigating turbulent waters.

The monitoring and maintenance phase remains an ongoing process, demanding consistent oversight to ensure optimal performance. This includes real-time analysis of system metrics, reviewing trade logs, and updating algorithms as needed in response to market evolutions. Technical oversight helps prevent disruptions by identifying bottlenecks or deficiencies and fine-tuning system components for sustained success.

| Deployment Steps | Description |

|---|---|

| **Hosting Provider** | Choose a provider offering low latency and proximity hosting options. |

| **Trading Environment** | Configure reliable data feeds, trade limits, and fail-safes. |

| **Monitoring and Maintenance** | Perform real-time analysis and updates for continuous optimization. |

As traders advance through the deployment process, focusing on these critical areas will ensure their HFT bot not only reaches the live market but excels in the high-stakes world of Forex trading. A meticulous deployment strategy solidifies a foundation for seamless operations, empowering the bot to operate with maximum efficiency.

Choosing a hosting provider

Select a provider that guarantees low latency and offers co-location services.

Setting up your trading environment

Comprises integrating data feeds and establishing secure, failure-tolerant connections.

Monitoring and maintenance

Continuous oversight to ensure stability and efficiency and quickly addressing potential issues.

Advanced HFT techniques

Building an HFT bot takes dedication, research, and technological acumen. But to leverage HFT to its highest potential, embracing advanced techniques is vital. Building on the basics learned from developing your HFT bot, these methods pave the way for more sophisticated and successful strategies by refining trade execution speeds and leveraging data-driven insights.

Low-latency trading

At the heart of high-frequency trading lies the concept of low-latency trading, where swift execution supersedes all. Low-latency trading is a relentless pursuit of reducing the time it takes for trade orders to reach the market. In this quest for millisecond advantages, traders deploy strategies such as colocation and Direct Market Access (DMA). By situating servers in proximity to exchange data centers, traders minimize the distance and, consequently, the time for information to travel, often less than the blink of an eye. DMA facilitates direct connections, bypassing traditional routes and allowing trades to reach the market at unbeatable speeds.

Ensuring fast and reliable trading connections involves intensive network optimization efforts. Using high-speed fiber optics and cutting-edge data routing technology ensures that trading signals face minimal interference. It’s akin to clearing pathways through a bustling city to ensure emergency services reach their destination unhindered and with laser precision.

Low-latency trading isn’t just about equipment; it’s about a holistic design that incorporates both hardware and software optimization for an integrated system. From using hyper-threading processes to maximize workload performance to developing streamlined code that processes data instantaneously, the race is about more than sheer speed it’s the embodiment of efficiency.

| Low-Latency Techniques | Description |

|---|---|

| **Colocation and DMA** | Hosts traders’ servers near exchanges and uses direct market access to ensure fast trading. |

| **Network Optimization** | Utilizes high-speed fiber optics and customized configurations for efficient data transmission. |

Low-latency trading provides the foundation for any successful HFT endeavor, ensuring that when trade opportunities arise, execution happens with immediate agility.

Colocation and Direct Market Access

Enhance speed by placing servers near exchanges and accessing markets directly for flawless execution.

Network Optimization

Ensure data pathways are unobstructed by employing the latest in fiber optics and data routing technologies.

Machine learning in HFT

Machine learning is revolutionizing high-frequency trading by offering enhanced predictive capabilities and execution efficiency. The intersection of machine learning with HFT promises to upend traditional trading practices through the adoption of predictive modeling. Machine learning algorithms excel at dissecting vast amounts of historical and real-time data to uncover complex patterns and trends, empowering traders to predict future price movements more accurately than ever before.

Moreover, the umbrella of algorithmic trading with AI allows for developing dynamic algorithms capable of self-learning and refining strategies automatically. These algorithms can respond to market volatilities, adapting execution based on real-time feedback mechanisms a practice comparable to a musician tuning their instrument to the nuances of a live performance, elevating the art form to real-time improvisation.

The integration of natural language processing (NLP) with HFT is also significant, allowing machines to interpret and analyze sentiment from news articles, social media, and forums to gauge market sentiment, reacting swiftly to changes. This scenario resembles a telescope with augmented lenses, giving traders clearer insights into market conditions.

| Machine Learning Applications | Description |

|---|---|

| **Predictive Modeling** | Uses algorithms to discern patterns for future price movement predictions. |

| **Algorithmic Trading with AI** | Develops self-learning, adaptable trading algorithms. |

| **NLP in Trading** | Gauges market sentiment through news and social media analysis. |

Incorporating these cutting-edge methodologies allows traders to harness data-driven insights and transform HFT strategies into more intuitive and intelligent systems. It’s the dawn of a new era in trading, demanding a nuanced understanding and implementation of machine learning approaches.

Predictive modeling

Machine learning algorithms enhance predictive accuracy by examining complex patterns and trends.

Algorithmic trading with AI

AI-based algorithms enable adaptable and self-learning trading strategies, adjusting in real time.

Ethical considerations in HFT

Ethical considerations in HFT are crucial, encompassing the moral and regulatory dimensions of trading. High-frequency trading raises fundamental questions, particularly regarding fair market access. It’s imperative to ensure transparent algorithms and trading technologies do not turn the market into a rigged playing field, favoring those with the most advanced technology. Trading should grant equal opportunities for all, akin to a fair race where each participant starts on equal footing.

Concerns about market manipulation are also prevalent, with certain strategies such as "quote stuffing" misleading the market by flooding it with orders that are never intended for execution. This can create false market signals and unwarranted volatility, distorting the balance that fair markets depend upon.

On the battlefield of insider trading, regulatory vigilance remains paramount. Trading bots must be carefully designed to prevent unethical practices where privileged information could be used unscrupulously for market gains. Maintaining confidence in financial markets calls for unwavering adherence to ethical conduct.

| Ethical Considerations | Description |

|---|---|

| **Fair Market Access** | Ensures equal opportunities through transparent trading technologies. |

| **Market Manipulation** | Prevents strategies that create false market signals. |

| **Insider Trading** | Guards against using privileged information for market advantages. |

Aligning HFT practices with ethical standards involves careful design and adherence to principles that sustain integrity and trust in financial markets. As a community, it’s essential to continuously refine and adapt ethical guidelines in tandem with advancements in trading technology.

Fair market access

Ensuring equal market access through transparent algorithms and trading technologies supports market fairness.

Market manipulation

Ethical HFT practices discourage strategies that can create misleading market signals and volatility.

Insider trading

Regulations must be stringent to prevent unethical trading practices and misuse of privileged information.

In conclusion, navigating the realm of high-frequency trading requires a dedication to advancing technology while ensuring ethical standards and legal compliance are diligently upheld. Strategy formulation, implementation, and ethical adherence culminate to empower HFT as a robust trading approach that, when executed effectively, can garner significant success.